Pallet Shrink Wrap Machine: The Ultimate 2025 Sourcing Guide

Introduction: Navigating the Global Market for Pallet Shrink Wrap Machine

In today’s interconnected supply chains, securing and protecting palletized goods is paramount for businesses aiming to minimize damage, reduce waste, and optimize logistics. Pallet shrink wrap machines offer a reliable solution for heat-shrinkable film applications, ensuring stability during transit and storage. As global trade expands, the demand for efficient, automated packaging equipment has surged, making these machines indispensable for manufacturers, distributors, and e-commerce operators in the USA and Europe.

However, selecting the right pallet shrink wrap machine amid a fragmented market presents significant challenges. Buyers must navigate diverse technological options—from semi-automatic to fully automated models—while contending with varying regulatory standards, such as FDA compliance in the US and CE marking in Europe. Factors like machine capacity, film type compatibility, energy efficiency, and integration with existing workflows add complexity, often leading to costly mismatches or overlooked opportunities for ROI.

This guide equips B2B decision-makers with actionable insights to confidently navigate this landscape. We’ll explore:

- Market Overview: Key players, trends, and regional differences between the USA and Europe.

- Machine Types and Features: Comparing shrink wrap technologies, capacities, and customization options.

- Buying Considerations: Evaluation criteria, cost-benefit analysis, and compliance tips.

- Best Practices: Implementation, maintenance, and future-proofing strategies for sustained efficiency.

By the end, you’ll be empowered to make informed purchases that enhance operational resilience and profitability. (248 words)

Top 10 Pallet Shrink Wrap Machine Manufacturers & Suppliers List

1. Phoenix Wrappers Pallet Stretch Wrap

Domain: phoenixwrappers.com

Registered: 2006 (19 years)

Introduction: Phoenix Wrappers is a leading manufacturer of stretch wrappers and stretch wrapping equipment with a full line of semi-automatic stretch wrap machines and high ……

2. Top 10 Pallet Wrapping Machine Manufacturers in the World

Domain: stretchwrappingfilm.com

Registered: 2022 (3 years)

Introduction: In this guide, we have meticulously listed some of the top pallet wrapping machine manufacturers globally to help you make an informed decision….

3. Robopac USA: Stretch Wrap Machine Manufacturers

Domain: robopacusa.com

Registered: 2017 (8 years)

Introduction: We offer the largest line of configurable machinery that are designed perfectly to stretch wrap, pack, palletize, erect, and seal any product….

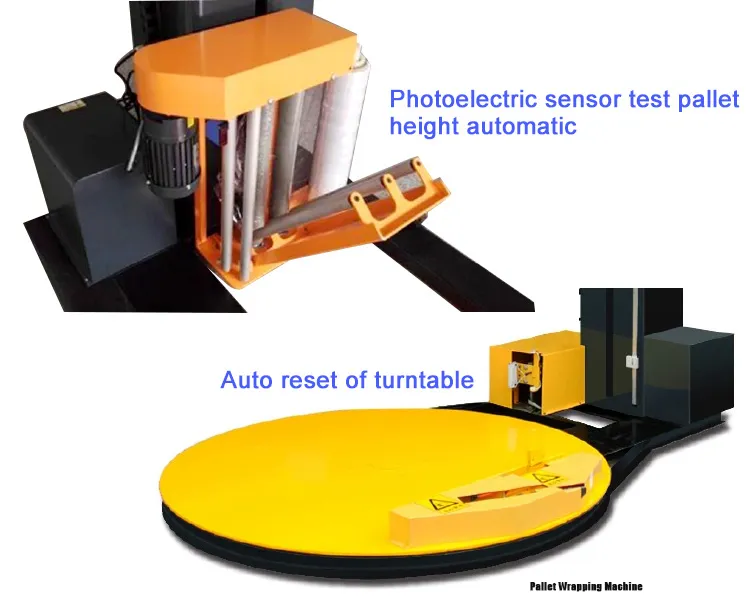

Illustrative Image (Source: Google Search)

4. Stretch Wrap Machines | Automate Wrapping for Higher Output

Domain: uspackagingandwrapping.com

Registered: 2011 (14 years)

Introduction: Automatic & Semi-Automatic Stretch Wrap Machines. Make pallet wrapping quick and hassle-free with our fully or semi-automatic stretch wrap machine….

5. Stretch Wrappers | Automatic & Semi-Auto Pallet Wrappers

Domain: shop.crownpack.com

Registered: 1997 (28 years)

Introduction: Crown Packaging is a top supplier of stretch wrappers & pallet wrapping equipment from leading manufacturers. Explore stretch wrap machinery….

6. Stretch Wrap Machines – Mr. Shrinkwrap

Domain: mrshrinkwrap.com

Registered: 1997 (28 years)

Introduction: 15-day returnsHere you will find equipment and machines used for unitizing or wrapping products on pallets. Semi or Automatic machines or systems that wrap pallets of items….

7. Pallet Wrapping machines – Premier Tech

Domain: ptchronos.com

Registered: 2009 (16 years)

Introduction: Discover our portfolio of stretch hooders, turntable and rotary arm stretch wrappers for various industries. Secure loads to protect them from damages….

Illustrative Image (Source: Google Search)

Understanding pallet shrink wrap machine Types and Variations

Understanding Pallet Shrink Wrap Machine Types and Variations

Pallet shrink wrap machines, commonly used in industrial and logistics operations in the USA and Europe, vary based on automation level, capacity, and features. Below, we outline four primary types, drawing from industry standards for stretch wrapping technology (often interchangeably referred to as shrink wrapping in some contexts). These machines apply plastic film to secure palletized loads, enhancing stability during storage and transport.

| Type | Features | Applications | Pros/Cons |

|---|---|---|---|

| Manual Shrink Wrap Machines | Hand-operated film dispensers; basic turntable or stand; low capacity (up to 2,000 lbs). | Small warehouses, low-volume operations, or manual assembly lines. | Pros: Low cost, simple operation, portability. Cons: Labor-intensive, slower for high volumes, inconsistent film tension. |

| Semi-Automatic Shrink Wrap Machines | Semi-automated wrapping with manual film attachment; includes turntables and scales; capacity up to 4,000 lbs. | Medium-sized distribution centers, retail logistics, and e-commerce fulfillment. | Pros: Balances automation and control, moderate speed, cost-effective for mid-volume. Cons: Requires operator intervention, higher energy use than manual. |

| Automatic Shrink Wrap Machines | Fully automated with sensors, conveyors, and PLC controls; high capacity (up to 5,000 lbs); customizable for load sizes up to 10 ft high. | High-volume manufacturing, large warehouses, and supply chain operations. | Pros: High throughput, consistent quality, reduced labor costs. Cons: Higher initial investment, requires maintenance and training. |

| Portable Shrink Wrap Machines | Mobile units with battery or manual operation; lightweight dispensers; variable capacity. | On-site wrapping at loading docks, construction sites, or remote locations. | Pros: Flexibility for diverse environments, easy setup. Cons: Limited capacity for heavy loads, potential for uneven wrapping without stabilization. |

Manual Shrink Wrap Machines

Manual shrink wrap machines are entry-level solutions ideal for businesses with low to moderate wrapping needs. They feature a simple turntable or stationary stand where operators manually feed and apply the film around the pallet load.

- Key Components: Basic film roll holder, tensioning system, and optional low-profile turntable.

- Operation: The operator rotates the pallet manually while wrapping the film, securing it with adhesive or heat.

- Best For: Startups, small-scale operations, or environments where budget constraints limit automation.

- Considerations: While cost-effective, they demand physical effort and may not suit high-volume workflows, potentially leading to inefficiencies in larger USA or European distribution hubs.

Semi-Automatic Shrink Wrap Machines

Semi-automatic models offer a step up in efficiency, combining manual input with automated wrapping cycles. They often include a powered turntable and can integrate scales for weight-based wrapping.

- Key Components: Motorized turntable, film pre-stretch mechanism, and optional digital controls or scales (e.g., for precise application).

- Operation: Operators load the pallet, attach the film, and initiate the cycle; the machine handles rotation and film application automatically.

- Best For: Growing businesses in retail or manufacturing sectors, where consistent output is needed without full automation costs.

- Considerations: These machines excel in balancing productivity and cost, making them popular in European logistics for medium-scale operations, though they require skilled operators to avoid film waste.

Automatic Shrink Wrap Machines

Fully automatic shrink wrap machines are designed for high-throughput environments, utilizing sensors and programmable logic controllers (PLCs) to handle the entire process independently.

Illustrative Image (Source: Google Search)

- Key Components: Integrated conveyors, load sensors, film cutting mechanisms, and customizable settings for load size (e.g., up to 10 ft height and 5,000 lbs capacity).

- Operation: Pallets are fed via conveyor; the machine detects load parameters, applies pre-stretched film, and cuts it automatically.

- Best For: Large-scale warehouses, automotive or food processing industries, and international supply chains in the USA and Europe.

- Considerations: They deliver superior speed and consistency, reducing labor by up to 70%, but initial setup and ongoing maintenance can be significant for B2B buyers focused on ROI.

Portable Shrink Wrap Machines

Portable variants provide flexibility for on-the-go wrapping, with lightweight designs that can be wheeled or carried to various sites.

- Key Components: Battery-powered dispensers, adjustable stands, and manual or semi-manual controls.

- Operation: Operators position the machine around the load and manually or semi-automatically apply the film, ideal for irregular sites.

- Best For: Construction, outdoor events, or temporary logistics setups where fixed machines are impractical.

- Considerations: Their mobility suits diverse European and USA applications, but they may lack the stability for heavy or oversized pallets, potentially compromising wrap quality.

Key Industrial Applications of pallet shrink wrap machine

Key Industrial Applications of Pallet Shrink Wrap Machines

Pallet shrink wrap machines, often used interchangeably with stretch wrap systems for secure palletizing, are essential in industries requiring efficient load stabilization and protection. The following table outlines key applications, drawing from capabilities like high-capacity turntables, customizable automation, and film efficiency to deliver operational advantages.

| Industry/Application | Detailed Benefits |

|---|---|

| Manufacturing | Enhances production line efficiency by automating the wrapping of heavy or irregularly shaped pallets (up to 4,000 lbs capacity), reducing material waste through 250% stretch ratios and minimizing downtime with semi-automatic or fully automatic models that integrate seamlessly into workflows. |

| Warehousing and Distribution | Improves inventory management by enabling quick, uniform wrapping of standard to extra-wide loads (up to 10 feet tall), ensuring load stability during transport and storage, while scalable turntables support high-volume operations and reduce labor costs. |

| Food and Beverage | Provides contamination-resistant protection for perishable goods on pallets, with machines offering smooth film application to maintain hygiene standards; high-capacity models (e.g., 3,500-5,000 lbs) accommodate bulk packaging, extending shelf life and optimizing supply chain reliability. |

| Pharmaceuticals and Healthcare | Ensures secure, tamper-evident wrapping for sensitive products, utilizing customizable automation to handle various load sizes without compromising sterility; features like integrated scales on models such as the Eagle 2000BWS allow precise weight monitoring for compliance and efficiency. |

| Retail and E-Commerce | Streamlines fulfillment processes by wrapping mixed-product pallets for shipping, with portable dispensers and turntables facilitating fast setup in variable environments; reduces packaging time, lowers shipping damage rates, and supports high-throughput operations in distribution centers. |

| Construction and Building Materials | Handles heavy, bulky loads (e.g., lumber or concrete) with robust turntables and film dispensers, providing weather-resistant protection; automatic machines minimize manual handling, enhancing safety and enabling customization for oversized or irregular shapes. |

3 Common User Pain Points for ‘pallet shrink wrap machine’ & Their Solutions

3 Common User Pain Points for Pallet Shrink Wrap Machines & Their Solutions

Based on industry insights from sources like ULINE, Veritiv, and U.S. P&W, pallet shrink wrap machines (often used for secure, heat-shrunk packaging) address efficiency in warehousing and logistics. Below, we outline three common pain points, each presented in a scenario/problem/solution format, with solutions informed by automated and semi-automatic machine features.

1. Inefficient Wrapping Process Leading to Time Delays

Scenario: A warehouse operator handles multiple pallets per shift, using manual shrink wrap machines that require significant setup and adjustment for varying load sizes, causing bottlenecks during peak hours.

Problem: Manual processes increase cycle times, reduce throughput, and contribute to labor fatigue, especially for non-standard pallets up to 10 feet high or extra-wide loads, as seen in stretch wrap equivalents.

Solution: Adopt semi-automatic or fully automatic shrink wrap machines, such as those with customizable workflows from U.S. P&W, which automate film application for smooth, consistent wrapping. This reduces setup time and supports higher output, with options for integration into existing lines for quick reordering and tracking via platforms like ULINE.

Illustrative Image (Source: Google Search)

2. Film Waste and Inconsistent Coverage Causing Product Damage

Scenario: In a distribution center, operators struggle with over-wrapping pallets, leading to excess film usage and uneven shrinkage that results in load instability or damage during transport.

Problem: Poor film tension and coverage waste resources (up to 250% stretch in some machines) and expose products to environmental factors, increasing rejection rates and costs, particularly for heavy loads up to 4,000 lbs as noted in Veritiv and ULINE listings.

Solution: Implement machines with precise control features, like the Eagle 2000B series from U.S. P&W, which offer adjustable stretch ratios and integrated scales for accurate film dispensing. Pair with training on machine manuals to minimize waste, ensuring secure, damage-free wrapping with benefits like free shipping on upgrades.

3. Maintenance Downtime and Equipment Reliability Issues

Scenario: A logistics manager faces frequent breakdowns in shrink wrap machines due to wear on components, halting operations and requiring external support for repairs on high-capacity turntables.

Problem: Unplanned downtime disrupts workflows, especially in automated setups, leading to lost productivity and higher maintenance costs, as highlighted in checklists from U.S. P&W for machines handling 3,500–5,000 lb capacities.

Solution: Select machines with robust build quality and support services, such as those from ULINE and U.S. P&W, including operation manuals, calibration instructions, and easy-access parts. Regular preventive checks, enabled by user-friendly features like scale calibration, ensure reliability and reduce downtime, with account benefits for quick reordering and express support.

Strategic Material Selection Guide for pallet shrink wrap machine

Strategic Material Selection Guide for Pallet Shrink Wrap Machines

In the B2B context of pallet shrink wrap machines—commonly used for securing pallet loads in logistics, manufacturing, and distribution across the USA and Europe—selecting the right materials is critical for optimizing efficiency, cost-effectiveness, and operational reliability. This guide analyzes key materials employed in these machines, drawing from industry standards and product specifications. It focuses on shrink films and machine components, emphasizing factors such as material properties, application suitability, and performance metrics. The analysis prioritizes materials that enhance load stability, reduce waste, and comply with regional regulations like those from the FDA in the USA or EU packaging directives.

Key Materials Used in Pallet Shrink Wrap Machines

Pallet shrink wrap machines primarily utilize heat-shrinkable films to create a tight, protective seal around palletized goods. The core materials include various polymers, with polyolefin and PVC being the most prevalent due to their balance of strength, clarity, and shrinkage efficiency. Supporting components, such as turntables and wrapping mechanisms, are constructed from durable metals and composites to handle high-capacity loads (e.g., up to 5,000 lbs as seen in models like the Eagle 2000B). Below is an analysis of primary materials, informed by product data from leading suppliers.

Illustrative Image (Source: Google Search)

Shrink Films

Shrink films are the consumable heart of shrink wrap machines, designed to contract under heat for secure packaging. Key types include:

– Polyolefin Films: Composed of polyethylene-based polymers, these offer high clarity, puncture resistance, and up to 50-70% shrinkage. Ideal for food and pharmaceutical packaging in Europe and the USA, where FDA compliance is essential. They provide excellent moisture barrier properties, reducing spoilage risks in humid environments.

– PVC (Polyvinyl Chloride) Films: Rigid and cost-effective, with shrinkage rates of 30-50%. Best for general industrial use, offering good printability for branding. However, they may release volatile compounds during heating, limiting their use in food applications per EU REACH regulations.

– Multi-Layer Coextruded Films: A composite of polyethylene and other polymers, delivering superior tear resistance and variable shrinkage (up to 80%). These are optimized for heavy or irregular loads, minimizing film waste by 20-30% compared to single-layer options.

Selection factors include:

– Thickness: Typically 30-100 microns; thicker films (e.g., 75 microns) suit high-abuse loads but increase material costs.

– Shrinkage Ratio: Higher ratios (e.g., 70%) ensure tighter wraps for unstable pallets, improving stability during transport.

– Environmental Impact: Opt for recyclable polyolefin variants to align with USA EPA guidelines and EU circular economy policies, reducing carbon footprint by up to 15%.

– Cost-Benefit Analysis: Polyolefin films often yield a 10-20% cost savings over PVC due to lower energy needs for shrinking and fewer regulatory restrictions.

Machine Components

While films are consumables, the machines themselves incorporate robust materials for durability and performance:

– Frame and Turntables: High-grade steel (e.g., galvanized or stainless) for corrosion resistance, supporting capacities up to 5,000 lbs as in models like the Eagle 2000B. Composites are emerging for lighter, portable designs, reducing setup time by 25%.

– Wrapping Mechanisms: Aluminum or reinforced polymers for rollers and dispensers, ensuring smooth film application. These materials minimize friction, extending machine lifespan to 5-10 years with proper maintenance.

– Control Systems: Electronics with ABS plastics and metal housings for automated models, integrating features like scales (e.g., Eagle 2000BWS) for precise weight-based wrapping, enhancing efficiency in high-volume operations.

Performance insights from sources like ULINE and U.S. P&W indicate that material choices directly impact output: semi-automatic machines with polyolefin films achieve up to 20% faster wrapping cycles than manual systems, while automatic models (e.g., 982 or 983 series) optimize for irregular loads through customizable stretch ratios up to 250%.

Illustrative Image (Source: Google Search)

Comparison Table of Key Shrink Films

| Material Type | Shrinkage Ratio | Key Strengths | Weaknesses | Typical Applications | Cost per Roll (USA/Europe Avg.) | Regulatory Compliance |

|---|---|---|---|---|---|---|

| Polyolefin | 50-70% | High clarity, puncture resistance, recyclable | Higher initial cost | Food/pharma packaging | $100-150 | FDA, EU REACH |

| PVC | 30-50% | Cost-effective, printable | Potential chemical release | General industrial | $80-120 | Limited in food apps |

| Multi-Layer Coextruded | 70-80% | Superior tear resistance, variable shrinkage | Complex production | Heavy/irregular loads | $120-180 | FDA, EU directives |

This table highlights trade-offs for strategic selection: Prioritize polyolefin for compliance-driven markets like Europe, while PVC suits budget-conscious USA operations. Always verify supplier data (e.g., from ULINE or Veritiv) for load-specific recommendations, and consider total cost of ownership, including energy for heating tunnels. For further optimization, consult machine manuals for integration tips.

In-depth Look: Manufacturing Processes and Quality Assurance for pallet shrink wrap machine

Manufacturing Processes

Pallet stretch wrap machines, such as models from ULINE and U.S. P&W (e.g., Eagle 1000B, 2000B, and 982 series), undergo a structured manufacturing process to ensure durability, precision, and reliability for industrial applications. Drawing from industry practices for automated and semi-automatic systems, the process typically includes the following steps:

1. Preparation

- Material Sourcing: High-grade steel, aluminum alloys, and electronic components (e.g., motors, sensors, and control systems) are procured from certified suppliers. For instance, components for turntables and wrapping arms are selected based on load capacities up to 5,000 lbs, as seen in Eagle series models.

- Design Validation: CAD software is used to model machine frames, ensuring compatibility with pallets up to 10 feet high and extra-wide loads. Specifications from product manuals (e.g., Eagle 1000B Operations Manual) inform design adjustments for features like stretch ratios up to 250% in models such as the 983.

- Component Inspection: Incoming parts are checked for defects using dimensional gauging and non-destructive testing to prevent issues in assembly.

2. Forming

- Frame Fabrication: Steel sheets are cut, bent, and welded using CNC machinery to form robust bases and supports. This step focuses on creating stable structures for turntables, as highlighted in U.S. P&W’s 4,000 lb capacity turntables.

- Component Shaping: Motors, rollers, and film dispensers are machined to precise tolerances. For example, wrapping arms are formed to handle semi-automatic or fully automatic operations, with customizations for varying pallet shapes.

3. Assembly

- Subassembly: Electronic and mechanical components are integrated, including PLC controls for automated wrapping cycles. Sensors and scales (e.g., in Eagle 2000BWS models) are calibrated during this phase.

- Final Integration: The complete machine is assembled on production lines, with wiring, hydraulic systems, and safety enclosures added. Turntables and dispensers are attached, ensuring smooth film application for loads of all sizes.

- Testing Runs: Preliminary operational tests simulate wrapping cycles to verify functionality, informed by checklists like the Stretch Wrap Machine Checklist from U.S. P&W.

4. Quality Control (QC)

- In-Process Checks: Each stage includes inspections for alignment, torque, and electrical integrity. Defective units are flagged and reworked.

- End-of-Line Testing: Machines undergo load testing (e.g., up to 5,000 lbs for Eagle 2000B) and cycle simulations to confirm performance. Film tension and wrapping speed are validated against specs.

- Packaging and Shipping: Finished units are packaged with manuals and support resources, ready for distribution.

Quality Assurance and Standards

Quality assurance for pallet stretch wrap machines emphasizes compliance with international standards to meet B2B demands in the USA and Europe. Key practices include:

- ISO Certifications: Manufacturers adhere to ISO 9001 for quality management systems, ensuring consistent production processes. ISO 14001 may apply for environmental controls in material sourcing and waste management.

- Safety and Performance Standards: Machines comply with CE marking (Europe) for electrical safety and machinery directives (e.g., 2006/42/EC). In the USA, they align with OSHA guidelines for industrial equipment, focusing on load stability and operator safety.

- Testing Protocols: Units are subjected to rigorous validation, including durability tests for high-output operations. Product flyers and manuals (e.g., from ULINE and U.S. P&W) detail certifications, such as UL listings for electrical components.

- Continuous Improvement: Feedback from field support (e.g., parts and service calls) drives refinements, ensuring machines like the Eagle 2000B maintain reliability in automated workflows.

This process results in machines optimized for efficiency, with features like customizable workflows and quick support, as promoted by leading suppliers.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘pallet shrink wrap machine’

Practical Sourcing Guide: A Step-by-Step Checklist for Pallet Shrink Wrap Machines

This checklist provides a structured approach to sourcing pallet shrink wrap machines, tailored for B2B buyers in the USA and Europe. It draws from industry resources to ensure informed decision-making, focusing on key considerations like machine types (automatic, semi-automatic, manual), capacities (e.g., 3,500–5,000 lb), and features (e.g., turntables, scales). Use this to streamline procurement and avoid common pitfalls.

Step 1: Define Your Requirements

Assess your operational needs to narrow options from suppliers like ULINE, Veritiv, and U.S. P&W.

– [ ] Identify load types: Standard pallets, oversized, or extra-tall (up to 10 ft).

– [ ] Determine capacity: Minimum weight (e.g., 3,500 lb for basic needs; 5,000 lb for heavy-duty).

– [ ] Select machine type: Automatic for high-volume efficiency, semi-automatic for moderate output, or manual for low-cost basics.

– [ ] List essential features: Turntable (high/low profile), scale integration, stretch percentage (e.g., 250%), and portability.

– [ ] Consider compliance: Ensure machines meet USA/EU safety standards (e.g., electrical certifications).

Step 2: Research Suppliers and Market Options

Compile a list of reputable vendors to compare availability and support.

– [ ] Review key suppliers: ULINE (wide range of automatic/semi-automatic), U.S. P&W (customizable with manuals), Veritiv (filtered search tools), and Mr. Shrinkwrap (security-verified listings).

– [ ] Check regional availability: Confirm shipping and support for USA/EU markets, including free shipping offers.

– [ ] Evaluate online resources: Use supplier websites for product flyers, manuals, and operation guides (e.g., Eagle 1000B/2000B specs).

– [ ] Note account benefits: Look for perks like order tracking, reordering ease, and express checkout.

Step 3: Compare Specifications and Pricing

Quantify options to match requirements with budget.

– [ ] Compare models: Create a table for easy reference (see below for sample).

– [ ] Assess costs: Factor in base price, shipping, and ongoing expenses (e.g., parts, film).

– [ ] Verify stretch efficiency: Prioritize machines with 250% stretch for material savings.

– [ ] Check customization: Ensure options for workflow integration (e.g., scale calibration).

Illustrative Image (Source: Google Search)

| Model | Supplier | Type | Capacity | Key Features | Price (USD) | Notes |

|---|---|---|---|---|---|---|

| Eagle 1000B | U.S. P&W | Semi-Automatic | 3,500 lb | Turntable, manual included | $6,884.92 | Suitable for standard loads. |

| 982 Pallet | U.S. P&W | Automatic | 4,000 lb | High-output wrapping | $7,350.00 | Ideal for high-volume. |

| Eagle 2000B | U.S. P&W | Automatic | 5,000 lb | Best-seller, scale option | $8,750.00 | Includes checklist/questionnaire tools. |

| Semi-Automatic | ULINE | Semi-Automatic | Varies | With/without scale | Varies | Account benefits for reordering. |

Step 4: Evaluate Quality and Reliability

Ensure long-term performance through reviews and testing.

– [ ] Review manuals and guides: Download PDFs (e.g., operations manuals from U.S. P&W) for setup and maintenance.

– [ ] Check user feedback: Seek testimonials on durability and support response times.

– [ ] Assess build quality: Prioritize machines with proven load handling (e.g., up to 10 ft heights).

– [ ] Test compatibility: Confirm integration with existing pallet systems in your facility.

Step 5: Negotiate and Finalize Purchase

Secure the best deal while mitigating risks.

– [ ] Request quotes: Contact suppliers for bulk or customized pricing.

– [ ] Review terms: Check warranties, return policies, and support (e.g., parts availability).

– [ ] Verify delivery: Account for USA/EU logistics, including free shipping thresholds.

– [ ] Finalize order: Use supplier portals for easy checkout and tracking.

By following this checklist, you can efficiently source a pallet shrink wrap machine that aligns with your B2B needs. For further customization, consult supplier resources directly.

Comprehensive Cost and Pricing Analysis for pallet shrink wrap machine Sourcing

Comprehensive Cost and Pricing Analysis for Pallet Shrink Wrap Machine Sourcing

This section provides a detailed breakdown of costs associated with sourcing pallet shrink wrap machines (also commonly referred to as stretch wrap machines in pallet wrapping contexts, based on industry standards). Pricing data is drawn from leading U.S. suppliers like ULINE and U.S. P&W, with considerations for both U.S. and European markets. Costs can vary based on machine specifications, such as capacity (e.g., 3,500–5,000 lb), automation level (semi-automatic or fully automatic), and additional features like scales or turntables. All figures are approximate and exclude taxes, which may add 7–20% in the U.S. (depending on state) and 20–27% in Europe (including VAT).

Illustrative Image (Source: Google Search)

Cost Breakdown

Materials

Materials encompass the machine itself, including components like the wrapping mechanism, film dispenser, and any integrated technology (e.g., scales or programmable controls). Prices typically range from $4,000 to $9,000 per unit for semi-automatic models, based on supplier data:

– Basic models (e.g., low-profile turntables or manual dispensers): $4,000–$5,000.

– Mid-tier semi-automatic (e.g., Eagle 1000B or 982 model): $6,000–$8,000.

– Advanced automatic with features (e.g., Eagle 2000B with scale): $8,000–$9,000+.

| Model Example | Supplier | Capacity | Base Price (USD) | Key Features |

|---|---|---|---|---|

| Pallet Turntable | ULINE | 4,000 lb | $4,596.80 | Manual operation, high-profile |

| Eagle 1000B | U.S. P&W | 3,500 lb | $6,884.92 | Semi-automatic, standard stretch |

| 982 Pallet Stretch Wrap | U.S. P&W | 4,000 lb | $7,350.00 | Semi-automatic, efficient wrapping |

| Eagle 2000B | U.S. P&W | 5,000 lb | $8,750.00 | Fully automatic, best-seller with scale option |

| Eagle 2000BWS | U.S. P&W | 5,000 lb | ~$9,000+ | Automatic with integrated scale |

In Europe, add 10–15% for import duties and currency fluctuations (e.g., EUR equivalent via current exchange rates). Bulk orders (5+ units) may reduce per-unit costs by 5–10%.

Labor

Labor costs include installation, training, and ongoing maintenance. These are often quoted separately by suppliers or third-party services:

– Installation: $500–$1,500 per machine, depending on site complexity (e.g., electrical setup, 4–8 hours of technician time at $50–$100/hour).

– Training: $200–$500 for operator sessions, covering machine operation and safety protocols.

– Maintenance and Repairs: Annual servicing at $300–$800, plus parts (e.g., replacement rollers or sensors at $100–$300 each). Factor in 1–2% of machine value annually for upkeep to avoid downtime.

In high-labor-cost regions like Europe, expect 20–30% higher rates due to skilled technician availability. U.S. markets may see lower costs in industrial areas.

Illustrative Image (Source: Google Search)

Logistics

Logistics involves shipping, handling, and delivery. Suppliers like ULINE and U.S. P&W offer free shipping on many orders within the U.S., but international shipments add costs:

– Domestic U.S. Shipping: $200–$500 per machine via ground freight; expedited options increase by 50–100%.

– European Shipping: $500–$1,500 per unit, including customs clearance and potential delays (2–4 weeks). Incoterms like DDP (Delivered Duty Paid) can simplify but add 10–15% to costs.

– Insurance and Handling: $50–$200 for fragile components; factor in 5–10% buffer for potential damage.

Total sourcing costs per machine often range from $5,000–$12,000, depending on model and location.

Pricing Analysis

Pricing varies by automation level, capacity, and supplier. Semi-automatic machines dominate mid-range budgets due to their balance of efficiency and cost. In the U.S., prices are competitive, with models like the Eagle 2000B seeing high demand for its scalability. European pricing may include higher VAT (e.g., 20% in the UK) and import fees, pushing totals 15–25% above U.S. equivalents. Negotiate for volume discounts: 10–15% off for orders over 10 units. Monitor for seasonal promotions, as suppliers like ULINE offer “Cyber Savings” deals.

Tips to Save Costs

- Bulk Purchasing: Order in lots of 5+ units to secure 5–10% discounts; combine with other warehouse equipment for bundled savings.

- Supplier Comparison: Compare U.S. P&W and ULINE for identical models; U.S. P&W often includes free manuals and support, reducing training costs.

- Opt for Semi-Automatic: Choose semi-automatic over fully automatic for 20–30% savings if high-volume wrapping isn’t needed.

- Leverage Financing: Explore supplier financing or leasing to spread payments over 12–24 months, avoiding upfront capital outlay.

- Minimize Logistics: Source locally (e.g., U.S.-based for U.S. buyers) to cut shipping; for Europe, use EU-based distributors to reduce duties.

- Maintenance Planning: Invest in preventive maintenance kits ($100–$200 annually) to extend machine life by 20–30%, lowering long-term repair costs.

Alternatives Analysis: Comparing pallet shrink wrap machine With Other Solutions

Alternatives Analysis: Comparing Pallet Shrink Wrap Machines with Other Solutions

Pallet shrink wrap machines are specialized for securing loads using heat-shrinkable film, offering efficient, automated wrapping for high-volume operations. However, businesses may consider alternatives based on factors like cost, speed, and load types. Below, we compare pallet shrink wrap machines with two common alternatives: stretch wrap machines and manual wrapping methods. The comparison focuses on key criteria including automation level, efficiency, cost, and suitability for different applications.

Illustrative Image (Source: Google Search)

Comparison Table

| Criteria | Pallet Shrink Wrap Machines | Stretch Wrap Machines | Manual Wrapping Methods |

|---|---|---|---|

| Automation Level | Fully or semi-automated; requires minimal operator intervention. | Semi-automatic to fully automated; often includes turntables for rotation. | Manual labor-intensive; no automation. |

| Efficiency (Loads/Hour) | 10-20 loads/hour (varies by model). | 15-30 loads/hour (e.g., Eagle 2000B at up to 25 loads/hour). | 5-10 loads/hour; slower due to human effort. |

| Cost (Initial Investment) | $5,000-$15,000 (depending on size and features). | $4,500-$10,000 (e.g., ULINE models from $4,596). | Low; $500-$2,000 for basic tools like dispensers and film. |

| Operating Costs | Moderate (film and electricity for heat); film costs $0.50-$1 per pallet. | Low (film only; no heat required); film costs $0.30-$0.80 per pallet. | Low to moderate; labor dominates (1-2 operators). |

| Film Type | Heat-shrinkable plastic film. | Self-adhesive stretch film (e.g., 250% stretch). | Stretch or shrink film; manual application. |

| Suitability | Ideal for irregular or oversized loads; provides tight, tamper-evident wrap. | Best for standard pallets; quick for high-volume, uniform loads. | Suitable for low-volume or irregular operations; flexible but inconsistent. |

| Maintenance | Requires regular upkeep of heating elements and conveyors. | Minimal; mostly film dispenser and turntable checks. | Low; primarily operator training. |

| Space Requirements | Compact footprint (e.g., 6×6 ft area). | Similar; includes turntable space. | Minimal space; no fixed equipment. |

Analysis

-

Pallet Shrink Wrap Machines vs. Stretch Wrap Machines: Shrink wrap machines excel in scenarios requiring a secure, heat-sealed finish, such as for products sensitive to shifting or environmental exposure, making them preferable for industries like food packaging or heavy goods in the USA and Europe. Stretch wrap machines, as seen in ULINE and U.S. P&W offerings, offer faster throughput and lower ongoing costs due to no heat requirement, but may not provide the same level of containment for non-uniform loads. Businesses with high-volume, standard pallet operations (e.g., logistics firms) might opt for stretch wrap for cost savings, while shrink wrap suits specialized needs.

-

Pallet Shrink Wrap Machines vs. Manual Wrapping Methods: Manual methods are the most cost-effective for small-scale or variable-volume operations, eliminating upfront equipment costs and allowing for adaptability without fixed setups. However, they suffer from inconsistency, higher labor demands, and lower speeds, leading to inefficiencies in B2B environments with growing demands. Shrink wrap machines provide a scalable upgrade, automating the process for reliability and reduced labor in warehouses across Europe and the USA.

When selecting a solution, evaluate based on production volume, load diversity, and budget. For customized options, consult suppliers like Veritiv for stretch alternatives or integrate shrink wrap for enhanced security.

Essential Technical Properties and Trade Terminology for pallet shrink wrap machine

Essential Technical Properties

Pallet stretch wrap machines are designed to securely wrap palletized loads with stretch film, enhancing stability and protection during storage and transportation. Below are key technical properties based on industry standards for machines targeting USA and European markets, with variations depending on model (e.g., automatic, semi-automatic, or manual).

Illustrative Image (Source: Google Search)

- Load Capacity: Typically ranges from 3,500 lbs (1,588 kg) to 5,000 lbs (2,268 kg), supporting standard to heavy-duty pallets. Higher capacities (e.g., 4,000 lbs or 1,814 kg) are common for semi-automatic models.

- Stretch Ratio: Measures film elongation; premium models offer up to 250% stretch for efficient material use and secure wrapping, reducing film waste by 20-30% compared to manual methods.

- Load Height Compatibility: Accommodates pallets up to 10 feet (3 meters) tall, with adjustable turntables (high or low profile) to handle varying load shapes and sizes.

- Turntable Specifications: Features include 4,000 lbs capacity turntables for smooth rotation, ensuring even film application. Low-profile options facilitate easy loading in space-constrained environments.

- Wrapping Speed and Automation: Semi-automatic machines wrap at 20-30 pallets per hour; fully automatic models can exceed 40 per hour, with customizable cycles for workflow optimization.

- Film Width and Thickness: Compatible with standard stretch film widths (e.g., 20-30 inches or 50-76 cm) and thicknesses (1-2 mil), with automatic dispensers for consistent tension.

- Power and Safety Features: Operates on 110-220V (single-phase), with safety sensors to prevent overloads and ensure operator protection. Some models include scales for weight verification (e.g., 2000BWS variant).

- Dimensions and Weight: Machines typically measure 60-80 inches (152-203 cm) in height and weigh 500-800 lbs (227-363 kg), designed for industrial settings with optional mobility features.

These properties ensure compliance with standards like those from ASTM for packaging machinery, focusing on durability and efficiency for B2B operations in logistics and warehousing.

Trade Terminology

In B2B transactions for pallet stretch wrap machines, understanding key trade terms is essential for negotiating purchases, shipping, and customization. Below is a glossary of common terms, tailored to USA and European markets.

- MOQ (Minimum Order Quantity): The smallest quantity a supplier requires for an order, often 1-5 units for machinery, depending on model. For high-capacity machines, MOQ may be lower to encourage bulk buys.

- OEM (Original Equipment Manufacturer): Refers to custom manufacturing where the buyer provides specifications for branded or specialized machines. Common for integrating proprietary features like enhanced stretch ratios.

- FOB (Free on Board): Incoterms rule where the seller bears costs and risks until goods are loaded onto the vessel at the specified port. Frequently used in USA exports, e.g., “FOB Los Angeles.”

- CIF (Cost, Insurance, and Freight): Incoterms where the seller covers costs, insurance, and freight to the destination port. Preferred in European imports for full responsibility transfer.

- Warranty Terms: Typically 1-2 years on parts and labor, with extensions available. Includes coverage for defects in materials or workmanship, often excluding wear from misuse.

- Lead Time: Delivery period post-order, usually 4-8 weeks for standard models, or longer for customized (OEM) units.

- Incoterms: International rules defining responsibilities for shipping, such as EXW (Ex Works) for buyer-handled transport or DDP (Delivered Duty Paid) for seller-managed full delivery, common in cross-border deals between USA and Europe.

- Customization Fees: Additional costs for non-standard features, e.g., integrating scales or adjusting turntable sizes, negotiated as part of OEM agreements.

These terms facilitate clear communication in procurement, ensuring alignment on pricing, delivery, and compliance with regulations like EU CE marking or US safety standards.

Navigating Market Dynamics and Sourcing Trends in the pallet shrink wrap machine Sector

Historical Evolution of Pallet Shrink Wrap Machines

Pallet shrink wrap machines, often confused with stretch wrap counterparts due to overlapping applications in load securing, emerged in the mid-20th century as an evolution from manual wrapping methods. The 1950s saw the introduction of heat-shrinkable films, revolutionizing packaging by allowing films to conform tightly to pallet loads under heat application. Early models were rudimentary, relying on manual labor and basic heat tunnels. By the 1970s, semi-automatic systems integrated conveyor belts and automated shrinking, driven by industrial growth in logistics and manufacturing. The 1990s brought advancements in programmable controls and higher-capacity machines, such as those from suppliers like U.S. P&W, which offered models like the Eagle 1000B (3,500 lb capacity) to handle varying load sizes up to ten feet. Today, the sector reflects a blend of shrink and stretch technologies, with shrink wrap emphasizing tamper-evident seals for high-value goods, while stretch wrap focuses on speed and cost-efficiency.

Illustrative Image (Source: Google Search)

Current Market Trends in the Pallet Shrink Wrap Machine Sector

The pallet shrink wrap machine market is experiencing robust growth, projected at a CAGR of 5-7% through 2025, fueled by e-commerce expansion and supply chain demands in the USA and Europe. Key trends include:

-

Automation and Integration: Fully automatic machines, such as the Eagle 2000B series from U.S. P&W (starting at $8,750), incorporate scales (e.g., Eagle 2000BWS at similar pricing) and IoT connectivity for real-time monitoring, reducing labor costs and improving efficiency. In Europe, integration with ERP systems is standard for compliance with EU packaging directives.

-

Demand for Versatility: Machines accommodating diverse load profiles—standard pallets, oversized (up to 4,000 lb), and tall loads—are in high demand. ULINE’s semi-automatic models with turntables (high and low profile) cater to small-to-medium enterprises, while U.S. P&W’s 982 and 983 models (starting at $7,350) offer 250% stretch capabilities for heavy-duty applications.

-

E-Commerce and Customization: Rising online retail drives the need for tamper-proof shrink wrap solutions. Customizable workflows, as seen in U.S. P&W’s offerings, allow for adjustments to pallet sizes and film types, aligning with US logistics trends like Amazon’s fulfillment centers.

Illustrative Image (Source: Google Search)

-

Regional Dynamics: In the USA, focus on high-volume operations; in Europe, emphasis on energy efficiency and regulatory compliance (e.g., REACH standards for film materials). Suppliers like Veritiv provide filtered search tools for tailored machine selection, reflecting buyer preferences for user-friendly interfaces.

| Trend | Key Drivers | Example Suppliers/Products |

|---|---|---|

| Automation | Labor shortages, efficiency gains | U.S. P&W (Eagle 2000B) |

| Versatility | Diverse load requirements | ULINE (Semi-Automatic with Scale) |

| E-Commerce Integration | Tamper-evident packaging | Veritiv (Filtered machine options) |

Sustainability in the Pallet Shrink Wrap Machine Sector

Sustainability is a core driver, with the industry shifting toward eco-friendly materials and energy-efficient designs to meet US EPA and EU Green Deal standards. Key aspects include:

-

Eco-Friendly Films: Transition from traditional polyethylene to bio-based or recycled shrink films reduces carbon footprints. Machines optimized for thin-gauge films, like U.S. P&W’s models with 250% stretch, minimize material usage without compromising load stability.

-

Energy-Efficient Operations: Modern machines feature low-power heat tunnels and regenerative braking in turntables, lowering energy consumption by 20-30%. ULINE’s portable dispensers and high-profile turntables support sustainable workflows by enabling precise film application.

Illustrative Image (Source: Google Search)

-

Circular Economy Practices: Suppliers emphasize recyclable film compatibility and machine longevity. In Europe, regulations mandate recyclability, prompting innovations in biodegradable shrink wraps. US-based companies like Mr. Shrinkwrap focus on security-verified, sustainable sourcing to ensure ethical supply chains.

-

Market Impact: Sustainable machines command premium pricing (e.g., U.S. P&W’s 983 at $8,450), but offer ROI through reduced waste and compliance incentives. Buyers in the USA and Europe prioritize certifications like ISO 14001 for environmentally responsible sourcing.

Sourcing Trends in the Pallet Shrink Wrap Machine Sector

Sourcing strategies are evolving toward digital platforms and global suppliers to balance cost, quality, and availability. Trends include:

-

Online Marketplaces: Platforms like ULINE and Veritiv enable easy comparison and ordering, with features like order tracking and express checkout. U.S. P&W offers detailed flyers and manuals for informed decisions, often with free shipping on qualifying orders.

Illustrative Image (Source: Google Search)

-

Global Supply Chains: US and European buyers source from North American manufacturers (e.g., U.S. P&W) for quick delivery and support, while international options provide cost advantages. Bulk purchasing of parts and films is common, with minimum quantities noted in listings (e.g., U.S. P&W’s pallet turntables starting at $4,596.80).

-

Customization and Support: Trends favor suppliers offering post-purchase support, such as parts availability and on-site training. Veritiv’s JavaScript-enabled filters streamline sourcing by capacity and features, while ULINE’s account benefits include reorder ease.

-

Regulatory and Compliance Sourcing: In Europe, sourcing prioritizes CE-marked machines for safety; in the USA, focus on FDA-compliant films for food-grade applications. Emerging trends include AI-driven procurement tools for predictive maintenance, reducing downtime.

To navigate these dynamics, B2B buyers should evaluate suppliers based on capacity, customization, and sustainability metrics, leveraging resources like U.S. P&W’s checklists and questionnaires for optimal machine selection.

Illustrative Image (Source: Google Search)

Frequently Asked Questions (FAQs) for B2B Buyers of pallet shrink wrap machine

Frequently Asked Questions (FAQs) for B2B Buyers of Pallet Shrink Wrap Machine

Q1: What is the difference between shrink wrap and stretch wrap machines for pallets?

Shrink wrap machines use heat to contract plastic film around pallets for a tight seal, ideal for moisture protection and unitization. Stretch wrap machines, like those from ULINE and U.S. P&W, apply pre-stretched film without heat, offering faster operation and recyclability. For B2B buyers, stretch wrap is often preferred for high-volume packaging due to its efficiency in automating wrapping for loads up to 10 feet high.

Q2: What key features should I consider when selecting a pallet shrink wrap machine?

Look for automation levels (fully automatic or semi-automatic), load capacity (e.g., 3,500 to 5,000 lbs as in Eagle 1000B and 2000B models), film stretch ratios (up to 250% in models like the 983), and add-ons like scales for weight tracking. Veritiv and ULINE emphasize customization for workflows, including turntables and dispensers, to ensure compatibility with standard or extra-wide pallets.

Q3: How do I determine the appropriate capacity for my pallet shrink wrap machine?

Assess your typical pallet weights and dimensions. Machines like the 982 or Eagle 2000B handle up to 4,000-5,000 lbs, suitable for heavy-duty B2B operations in manufacturing or logistics. For oversized loads (up to 10 feet high), opt for high-profile turntables. Calculate ROI based on output volume—U.S. P&W notes that automated models reduce wrapping time by up to 50% for higher throughput.

Q4: What maintenance is required for pallet shrink wrap machines?

Regular checks include film tension adjustments, turntable lubrication, and sensor calibrations, as outlined in manuals for models like the Eagle 2000B. Parts availability is key—providers like ULINE and U.S. P&W offer easy access to components. Schedule annual inspections to prevent downtime, ensuring compliance with safety standards in the USA and Europe.

Illustrative Image (Source: Google Search)

Q5: Can pallet shrink wrap machines meet international shipping standards?

Yes, many models comply with ISPM 15 for phytosanitary treatments and ASTM standards for durability. In Europe, ensure CE marking for safety; in the USA, focus on FDA-approved films for food-related shipments. Stretch wrap machines from Veritiv and U.S. P&W are designed for global logistics, handling diverse pallet sizes for exports.

Q6: What are the typical pricing ranges and ROI for these machines?

Prices range from $4,596 for basic turntables (e.g., U.S. P&W’s Pallet Turntable) to $8,750 for advanced models like the Eagle 2000B. ROI is driven by reduced labor costs and faster cycles—B2B buyers often see payback in 6-12 months through increased efficiency. Factor in energy savings and customizable options to justify investment.

Q7: What customization options are available?

Options include integrated scales (e.g., Eagle 2000BWS for weight verification), variable speed controls, and film dispensers. ULINE and U.S. P&W allow tailoring for specific workflows, such as semi-automatic with scales for inventory accuracy. For B2B needs, request modifications for load heights or integration with conveyor systems.

Q8: How do I access support and parts for pallet shrink wrap machines?

Contact manufacturers or distributors like ULINE, Veritiv, or U.S. P&W for parts, manuals, and training. Many offer 24/7 support, with free shipping on orders in the USA and Europe. Track orders via account portals for seamless reordering, ensuring minimal downtime in your operations.

Illustrative Image (Source: Google Search)

Strategic Sourcing Conclusion and Outlook for pallet shrink wrap machine

Strategic Sourcing Conclusion and Outlook for Pallet Shrink Wrap Machines

Strategic sourcing of pallet shrink wrap machines delivers substantial value for B2B operations in the USA and Europe, optimizing supply chain efficiency and cost management. By partnering with reputable suppliers like ULINE, Veritiv, and U.S. P&W, businesses access a range of automated and semi-automatic models, such as the Eagle 2000B (capacity up to 5,000 lbs, priced at $8,750) and 983 series (4,000 lbs with 250% stretch at $8,450), tailored to handle diverse pallet sizes up to 10 feet high.

Key benefits include:

– Enhanced Productivity: Automation reduces manual labor, enabling quick wrapping for higher output and seamless integration into workflows.

– Cost Savings: Features like scales (e.g., Eagle 2000BWS at $8,750) minimize film waste, while competitive pricing and free shipping lower procurement expenses.

– Reliability and Support: On-demand parts, manuals, and express checkout ensure minimal downtime, backed by robust security checks for secure transactions.

Looking ahead, the outlook for pallet shrink wrap machines emphasizes sustainability with eco-friendly films and advanced automation for Industry 4.0 compatibility. As e-commerce grows, demand for customizable, high-capacity units will rise, driving innovations in energy-efficient designs. Strategic sourcing positions firms to leverage these trends, fostering resilient, efficient operations in competitive markets. (198 words)

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.